Print

Print

--- Review of Issues of Debt Financing Tools by Non-financial Enterprises in 2010

In 2010, spurred by the strategic decision of the CPC Central Committee and the State Council to enhance the financial support to the economy, China’s debt capital market attained the rapid and healthy development. Besides large-sized enterprises, small and medium-sized issuers obviously increased, the regional distribution of these issuers became more diversified, the business distribution of the lead underwriters went balanced, the number of issues in the year grew 10.9% year on year, and the outstanding scale of bonds at the end of the year broke RMB2.1 trillion, jumping 61.4% over a year earlier.

The consolidated scale of the non-financial enterprise financing tools (including CP[1], MTN[2], SMECN[3], Huijin bond and SCP[4]) issued with the registration with the NAFMII amounted to nearly RMB1.3 trillion[5], 75.5% of the total direct debt financing scale of the enterprises; the cumulative scale of the issues added up to RMB3.8 trillion, 67.8% of the total; and the outstanding balance at the end of 2010 exceeded RMB2.1 trillion, representing 55.3% of the total, compared to 39.2% at the end of 2007. Debt financing tools for non-financial enterprises have become an important channel of direct financing of enterprises.

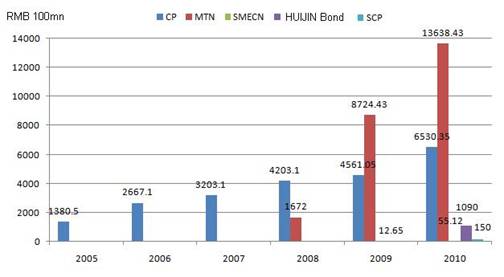

(I) Issuing scale of CP dramatically rose, MTN fell slightly, and the overall scale grew 10.9%

In 2010, nearly 500 enterprises registered the issuance of the non-financial enterprise debt financing tools, valued at RMB1,296.647 billion, growing 10.9% over the prior year, with the NAFMII. Of the figure, the issuing scale of CP exceeded RMB670 billion, a jump of 46% year on year, the issuing scale of MTN fell 30% from a year earlier to some RMB500 billion; and the total value of SMECN, Huijin debt and SCP reached RMB120 billion.

(II) MTN took more than half of the balance, and the CP balance rose evidently

At the end of 2010, nearly 900 non-financial enterprise debt financing tools remained in duration, and involved an outstanding amount of RMB2,146.39 billion, growing 61.4% over 2009. The duration of CP is less than one year, so the large number of issues drove the balance to grow 43% year on year, and the CP balance at the end of the year to exceed RMB650 billion. The duration of MTN usually ranges from three years to five years. Due to the accumulating balance in recent years, the ending balance in 2010 exceeded RMB1.3 trillion, representing more than 60% of the total balance of the debt financing tools.

Figure 1: Ending Balances in 2005-10

(III) Midsized underwriters saw rapid business growth, and the gap between large and medium-sized underwriters narrowed[6]

In 2010, 24 lead underwriters all actively participated in underwriting non-financial enterprise debt financing tools. The Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB), China Merchants Bank (CMB) and the Agricultural Bank of China (ABC) underwrote more than 70 tools respectively, and these underwriters put together accounted for 41% of the total, a drop of 4 percentage points from 2009; the Industrial Bank Co., Ltd., China CITIC Bank, Bank of China and Bank of Communications underwrote 50-70 tools; and Shanghai Pudong Development Bank, China Minsheng Banking Corporation Limited and Bank of Beijing underwrote 40-50 ones. This indicates the business volumes of the large and medium-sized underwriters have no obvious difference, and the business volumes of most underwriters grew considerable over the prior year.

(IV) The center of gravity of ratings of CP issuers still fell between AA and AA-, while that of MTN moved downward

In 2010, the credit ratings of the CP issuers mainly ranged from AA to AA-, and the issuers rated at these two grades account for 56% of the total issuers, and the enterprises with the higher ratings (AAA and AA+) put together take less than 40% of the total. The distribution is basically similar to that in 2009. The distribution of the credit ratings of the MTN issuers changed to some extent compared to that one year ago: The proportion of the enterprises rated at AA evidently rose to 27%, and approached the proportion of the AAA and AA+ enterprises at 34%, and the distributions of the enterprises at these different grades are relatively uniform; among the MTN issuers in 2009, the AAA enterprises alone accounted more than half of the total issuers; and the MTN issuers presented an obvious trend of moving downward in credit rating. Judging from the issuing scale, that of the AAA enterprises is relatively large, while the scales of the CP and MTN issued by AAA enterprises remain at a high level, exceeding 60% respectively.

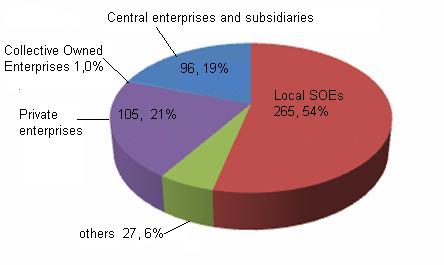

(V) Local state-owned enterprises took more than half, and the number of private enterprises evidently rose

Judging from the number of issuers, 265 local state-owned enterprises accounted for 54% of the total, while the proportion of the central enterprises directly under the State Council and their subsidiaries fell 7 percentage points from 2009 to 19%. The participation of the private enterprises presented an obvious increase, after the launch of the SME collective note. In 2010, more than 100 private enterprises issued the debt financing tools, and represented 21% of the total, a rise of 8 percentage points over the previous year, which has overtaken the proportion of the central enterprises directly under the State Council and their subsidiaries. Non-financial enterprise debt financing tools have provided an efficient financing channel for private enterprises, played an active role in realizing the efficient and reasonable allocation of the social resources, and promoted the universal development of the national economy.

Figure 2: Distribution of Issuers of Non-financial Enterprise Debt Financing Tools in 2010

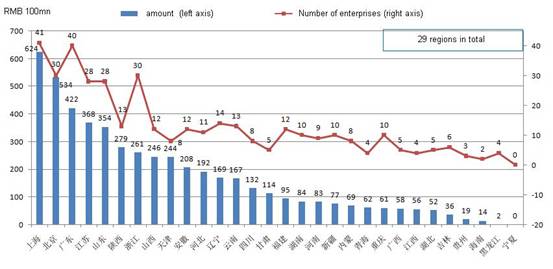

(VI) The issuing scale gap between the regions gradually narrowed, and the distribution of the regions went balanced

If the issues of the central enterprises directly under the State Council, their subsidiaries, state organs and their enterprises, the issuers from Shanghai, Guangdong, Beijing, Zhejiang, Jiangsu and Shandong were in the large quantity, and accounted for 51% of the total. As to other provinces and municipalities, there are 16 provinces and municipalities that had more than 10 issuers in 2010, while this figure was only 6 in 2009. The participation of the enterprises from different provinces and municipalities generally increased, the gap in the number of issues was not very large, and the distribution of the non-financial enterprise debt financing tools became more balanced in different regions nationwide.

As to the issuing amount, the differences among different provinces and municipalities reduced in 2009. Shanghai, Beijing, Guangdong and Jiangsu, which ranked the top four, accounted for 38% of the total amount, a sharp decline from the figure of 60% in 2009. This also indicates the enterprises from other provinces and municipalities have participated in the direct debt financing market.

Figure 3: Regional Distribution of Non-financial Enterprise Debt Financing Tools in 2010

(Excluding Central Enterprises and Enterprises under Ministries)

To conclude, in 2010, the non-financial enterprise debt financing tools broadened the financing channels of the enterprises, provided an efficient and low-cost financing option for more enterprises, enhanced the width and depth of the interbank bonds market and played an important role in building a multilevel capital market system.

2011 is the starting year of the Twelfth Five-year Plan. “Stabilizing growth” and “adjusting structure” will become necessary factors to realize the long-term social harmony and stability in China, after the CPC Central Committee and the State Council established the objective of “realizing the steady and rapid economic development, keep the basic stability of the general price level, and making the significant progress in the strategic adjustment of the economic structure”. The NAFMII will actively respond to the requirement identified in the Twelfth Five-year Plan – “accelerate the construction of the multilevel capital market system, evidently increase the proportion of direct financing, and actively develop the bonds market”; continue to uphold the market-oriented concept; adhere to the direction of orienting institutional investors; actively play the role of the market self-discipline organization in the “government, self-discipline organization and market institution” integrated administration mode; perfect the market-oriented issuance management, pricing mechanism, constraint mechanism and risk management mechanism; enrich the varieties and term structures of non-financial enterprise debt financing tools; fully stimulate the enthusiasm of market participates; inspire the innovative capacity and internal vigor of the market; effectively satisfy diversified financing demands of various issuers; continue to drive the continuous and healthy development of China’s debt capital market, serve the overall steady and rapid development of the national economy and contribute to realizing the vision of building our country into an overall well-off society.

[1] Means short-term financing note, the same below.

[2] Means the mid-term note, the same below.

[3] Means the SME collective note, the same below.

[4] Means the Super & Short-term Commercial Paper, the same below.

[5] An MTN in US dollar is converted into RMB at the exchange rate on the issuing date.

[6] They jointly underwrote one tool respectively.