Print

Print

September 3, 2012 is the fifth anniversary of NAFMII. On August 31, NAFMII held a symposium to celebrate the great event in Beijing. Among those present at the meeting are leaders of relevant organizations, such as Zhou Xiaochuan, Governor of the People’s Bank of China (PBOC), Xiang Junbo, Chairman of China Insurance Regulatory Commission (CIRC), Yang Kaisheng, President of Industrial and Commercial Bank of China (ICBC), and Li Jun, Chief Supervisor of Bank of China (BOC), as well as representatives of NAFMII members. Governor Zhou delivered a speech at the symposium.

Governor. Zhou pointed out that the interbank bond market has seen leapfrog development in recent years. It has emerged to take an increasingly prominent position in the national economy and play an important role in macroeconomic control, capital allocation, market pricing and risk management.

Governor Zhou Xiaochuan addresses at the symposium

Governor. Zhou noted that the establishment of NAFMII conformed to the grand trend of the reform of the market economy system and the administrative system in China, and represented an important system innovation amid the reform and development of China’s financial market. Since day one, NAFMII has observed the development path of the bond market, focused in the OTC market, and positioned institutional investors as the main investors in the market, NAFMII introduced registration system to replace the traditionally practiced approval system, and adhered to market-oriented development approach in the interbank market. Through these efforts, NAFMII has developed a management mode combining government supervision and market self-regulation, and preliminarily implemented the approach with appropriate control and deregulation in corresponding fields, and thus greatly boosted market activities, and effectively promoted the development of not also the interbank bond market, but also the entire financial market in China.

Governor Zhou added that NAFMII has vigorously driven the leapfrog development of the interbank bond market with rapid expansion of market scale through such efforts as giving full play of the market members, and accelerating innovation of system and financial products by closely centering on demands of the real economy. By the end of July 2012, the outstanding volume of debt financing instruments of non-financial enterprises had amounted to RMB 3.59 trillion, representing 60% of corporate direct debt financing scale in China, and the balance of general corporate credit bonds reached RMB 6.2 trillion, representing 25.8% of the total outstanding volume of China’s bond market. The bond market scale has ranked the third in the world and the second in Asia.

NAFMII holds the fifth anniversary symposium

Governor Zhou noted that NAFMII has innovatively launched short-term commercial papers (CP), super & short-term commercial papers (SCP), medium-term notes (MTN) and asset-backed notes (ABN) adding to existing products, as well as the credit risk mitigation instruments (CRM), as pioneer products in credit derivatives market. NAFMII also introduced private placement mechanism as an alternative to public issuance for debt financing instruments. The coexistence for OTC and exchange bond markets, which are specialized and interconnected, has been beneficial to economic development.

Governor Zhou stressed that NAFMII must unwaveringly follow the market-oriented approach, and continue to promote rapid and healthy development of the bond market. learn from experience, carry out bold explorations, and gradually build itself into a new type of self-regulatory organization in China’s OTC financial market. NAFMII needs to contain its aspiration for system and product innovation in order to address new problems and different situations as market further development, formulate relevant market standards, and establish an entire set of market standard system to guide business conducts of market members. It’s also important to fully stimulate the enthusiasm of market players, and establish a market-oriented self-regulatory management mechanism to gradually optimize the market regulatory framework combining government administration with self-regulatory management. NAFMII needs to establish the market convention, promote and implement the code of conducts and ethics for market players, regulate market conducts, coordinate interests of members, and establish and advocate the code of market ethics and the concept of market justice featuring benign competition. While introducing the experience of mature markets, NAFMII needs to actively participate in the government’s effort to open up the Chinese financial market according to the overall arrangement for liberation of Renminbi, and continuously enhance China’s participation and influence in establishing standards for international financial market.

Governor Zhou said that according to the uniform arrangement of the State Council, the People’s Bank of China, China Securities Regulatory Commission and the National Development and Reform Commission have established the interdepartmental coordination mechanism and held the first meeting in which a consensus was reached on the concept for further reform and development of the corporate debenture market. Based on respective roles, relevant departments would, within the responsibilities granted by the law, perform their duties, and strengthen information sharing and policy coordination. Relevant departments and market members should also support exploration and practice in the new self-regulatory management to jointly promote the market development.

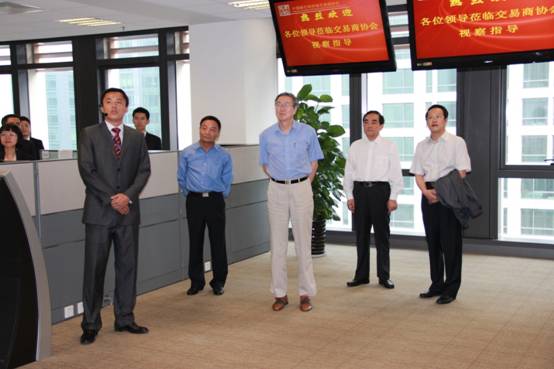

Mr. Xiang Junbo, Chairman of NAFMII, presided over the symposium. Mr. Shi Wenchao, Secretary-General of NAFMII reported the progress NAFMII has made over the last five years since its foundation in self-regulation, innovation, service and other aspects to build a new self-regulatory organization. ICBC President Yang Kaisheng, BOC Chief Supervisor Li Jun, Wang Dongming, Chairman of CITIC Securities, Wang Guoliang, Chief Accountant of PatroChina, as well as representatives of NAFMII members and representatives of NAFMII staff took the floor. Leaders of relevant departments of the Ministry of Civil Affairs also delivered speeches. Nearly 100 people participated in the symposium, including the leaders of relevant departments of PBOC, CBRC, CSRC, and other relevant ministries as well as the representatives of NAFMII members. Before the symposium, the leaders also viewed a presentation regarding the newly launched Debt Capital Market Filing Analysis Notification System platform (DCM - FANS) and the trading monitoring room of NAFMII. NAFMII received congratulatory letters and telegraphs from the governments of 21 provinces, autonomous regions and municipalities, Xinjiang Production and Construction Corps, 24 lead underwriters and more than 30 enterprises in celebration of the fifth anniversary of NAFMII.

Governor Zhou Xiaochuan (third from left), Chairman Xiang Junbo (first from right), President Yang Kaisheng (second from right) and other leaders viewed the presentation on DCM-FANS platform..

Governor Zhou Xiaochuan (second from left), Chairman Xiang Junbo (third from left), Deputy Governor Liu Shiyu (sixth from left), President Yang Kaisheng (fourth from left), Chief Supervisor Li Jun (fifth from left) and other leaders are listening to introduction of the trading monitoring system of NAFMII